Zim retail and banking sectors lurch into crisis

POS terminals are used to process credit cards, debit cards, smart chip cards and other electronic transactions in most retail outlets in the country. The POS terminals had become the preferred means of payment for grocery and other purchases because of the acute cash shortage in the country.

Bankers said their systems had been overwhelmed to the point of near-paralysis after a sharp surge in zeros on the country's currency at the end of June and first week of this month, forcing some banks to ‘manually feed salaries and other payments' into depositors accounts.

“We have had to lop off the zeros from the figures in our systems but the zeros are presenting a major challenge because they are accumulating every day,” a banker said.

VISA POS terminals, issued by British-owned Standard Chartered Bank, are not accepting transactions from other VISA-linked banking institutions like MBCA Bank, NMB Bank, Barclays Bank and Stanbic Bank.

Shoppers trooped at POS terminals from CABS, a subsidiary of Old Mutual Plc, and Kingdom Bank, which have the Zimswitch facilities shared by most banks. This resulted in most supermarkets operating these POS machines having long queues of dejected shoppers waiting for their turn at the POS terminals.

A shopper at a Five Avenue Spar supermarket in Harare said he had waited six hours before being able to buy his small grocery.

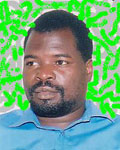

“You have to be patient because just one day with your money in the bank is a huge loss because prices are changing every day,” said Dumisani Nyathi, holding a small grocery item.

Tellers have to make multiple transactions for POS purchases above $10bn because of the high number of zeros. The cheapest packet of meat costs over $200bn, translating to 20 transactions, while a loaf of bread, barely available on the formal market, is retailing at $50bn, or five transactions on a POS terminal.

“Most of the shoppers have no cash because the minimum daily withdrawal limit is $100bn, which really doesn't buy anything. So the POS machines are the alternative but it's a nightmare for both our staff and the customers because a single transaction can take up to 30 minutes,” supermarket manager, Tawanda Gurupira, said.

Some POS terminals were rejecting transactions from banks that had lopped off zeros because they were transmitted as having insufficient funds.

Governor of the Reserve Bank of Zimbabwe, Gideon Gono, lopped three zeroes off the Zimbabwe dollar in August 2006 after inflation ruined the currency, pushing transactions into billions of dollars. But the zeros appear to have come back with a vengeance, with most transactions going into trillion dollar levels.

The country currently has at least 27 types of recently introduced notes of different denominations in circulation, but most have already become obsolete because of inflation. The highest is currently a $50bn agro bearer cheque introduced in May. The country has been printing so-called bearer cheques since 2003 because the fast erosion of the currency has made it untenable to print real money.