Zimbabwe allows miners, exporters to keep more forex from exports

The new measure, however, falls short of miners' demands to keep 80% of their export earnings in foreign currency.

The foreign currency-starved southern African country requires all exporters to convert part of their export earnings into local currency at an official exchange rate significantly higher than the widely used black market exchange rate, leading to losses for the businesses.

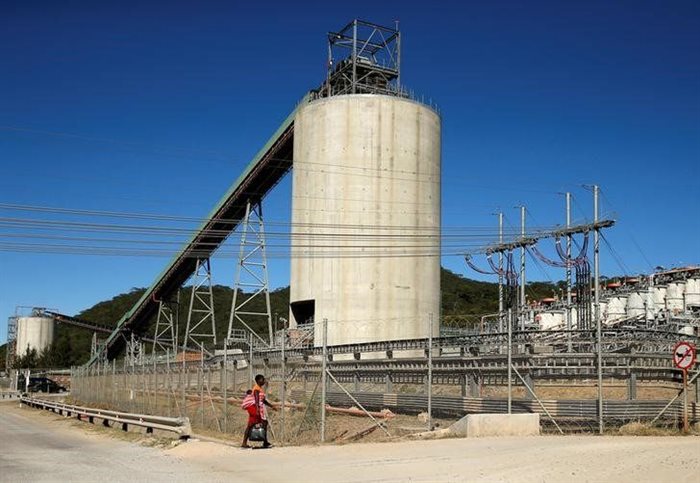

Some international miners with operations in Zimbabwe include Anglo American Platinum, Impala Platinum, Sibanye Stillwater, Zhejiang Huayou Cobalt, Sinomine Resource Group, Tsingshan Holding Group and Sinosteel Corporation.

"Export retentions have been increased and standardised at 75% across all sectors," the Reserve Bank of Zimbabwe (RBZ) said in a monetary policy statement on Thursday.

Investor concerns

Zimbabwe has significant mineral resources, including gold, platinum group metals, coal and lithium, which has attracted international firms, especially from China. Over the years, the country has struggled to attract significant foreign investment due to concerns over foreign currency rules and policy uncertainty.

In December, Zimbabwe banned raw lithium exports, targeting marauding artisanal miners who were digging up old mines in search of the mineral.

However, the ban triggered fears Zimbabwe could be defaulting to a resource nationalism stance, four years after the government scrapped a law that required local control of all major mines.

Source: Reuters

Reuters, the news and media division of Thomson Reuters, is the world's largest multimedia news provider, reaching billions of people worldwide every day.

Go to: https://www.reuters.com/Related

ArcelorMittal South Africa is in talks to defer long steel plant closure 24 Mar 2025 Mining veteran, Ben Magara appointed Exxaro CEO 13 Mar 2025 Rainbow Chicken rebounds with profit surge, cautions on bird flu impact 7 Mar 2025 PGM crisis makes Implats consider Canada closure 28 Feb 2025 Rains affect Amplats Tumela production 24 Feb 2025 Post-election unrest hits Maputo port volumes 22 Jan 2025